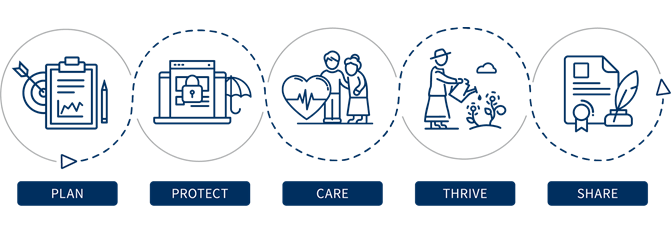

Your quality of life— carefully considered

Life is full of big questions: How are you building toward your long-term goals while meeting your short-term needs? How can you share what you've accomplished with your loved ones? How will you lead and prepare for the lifestyle you envision?

Explore how our approach to longevity planning helps you answer tomorrow's big questions today.

Holistic planning - for your financial life

The future you envision starts with making a plan today. Our longevity resources are designed to help you unlock new levels of financial confidence through integrated goal planning with your advisor. Learn how to lead thoughtful conversations about wealth and health with your family and build a holistic plan that puts you and your loved ones at the center of every decision.

Goal Planning & Monitoring

This sophisticated wealth planning tool shows your full financial picture. It takes into account your specific goals, investment strategy, risk tolerance, spending and saving rates – and tells you the probability of achieving your goals*.

*IMPORTANT: The projections or other information generated by Goal Planning & Monitoring regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. Asset allocation does not guarantee a profit nor protect against loss.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Longevity planning isn’t just about investment management. It’s also about protecting yourself and your loved ones, so you can make the most of what the future holds. Explore the services we offer to safeguard your hard-earned savings, your identity and even your health.

EverSafe

EverSafe seeks to shield you and your loved ones from financial fraud through a proprietary algorithm that monitors accounts for unusual activity. Alerts are sent to you and anyone you designate as a trusted advocate. You can also protect loved ones by serving as their trusted advocate. And if any issues are detected, EverSafe helps you manage the resolution process and create a recovery plan.

ClearMatch

Make the most of Medicare with ClearMatch, with unbiased agents to help you compare your options and find the most cost-effective plan – all while ensuring appropriate coverage for your preferred providers, doctors and medications.

EverSafe and ClearMatch are not affiliated with Raymond James.

As longevity planning specialists, we understand the costs and commitment that come with caregiving. Whether you’re seeking care support, serving as a caregiver or partnering with loved ones for family care management, our resources help you navigate every aspect of health and wellness.

Broadspire Care Management

Plan for the greatest financial factors in retirement – housing and healthcare – with Broadspire Care Management. When you’re ready, one of their dedicated care experts can visit your home to assess, recommend and facilitate strategies for aging in place as well as help you address additional care needs, from minor home modifications to finding the best memory care facility.

PinnacleCare

A concierge health service, PinnacleCare maintains relationships with top-ranked medical centers across the country and works with you to source the best treatment options, schedule appointments, seek second opinions from trusted specialists and more.

Broadspire Care Management and Pinnaclecare are not affiliated with Raymond James.

Retirement doesn’t mean closing the chapter on your life’s purpose. Instead, it’s an opportunity to redefine it. This might include an encore career or volunteering for causes near and dear to you. If you’re not sure what makes your heart soar, ask yourself: What activities do I enjoy and how do I stay connected with my community? What are my personal goals? When do I feel most fulfilled?

We can help guide you through each facet of your life, including your post-retirement years, and connect you with resources that prioritize your well-being and happiness.

A legacy is so much more than what you’ll one day leave behind. It’s about passing on cherished memories, sharing your stories and helping instill your values in future generations. It’s about creating a gift that extends far beyond your wealth.

Everplans

A meaningful legacy includes organizing and sharing critical information with your loved ones – and that’s where Everplans can help. Through its step-by-step process, Everplans enables you to organize important documents – from your will and end-of-life wishes to your favorite family recipes – in a secure online database, which can be shared with trusted family and friends whenever you decide.

Everplans are not affiliated with Raymond James.

Raymond James is not affiliated with any of the companies mentioned.